The following is a brief analysis of Health Insurance Ambetter along with reviews, policies, types of plans, costs, and several other noteworthy points.

Basically, Ambetter Health Insurance is a health insurance plan provider, whose main business is to provide health insurance products to different companies.

These insurance companies then offer these plans to individuals through various state marketplaces.

Comparing Ambetter to other health insurance plans, its rates are among the lowest, but it is not available in all states.

For basic coverage and member benefits at a reasonable price, Ambetter’s health insurance plans are your best choice.

Unfortunately, the company has poor ratings, and should not be considered if you want a company that will provide great customer service.

Availability of Policies

There are various insurance companies offering Ambetter health plans in select states.

Some of these companies include:

|

State

|

Company

|

|---|---|

| Arkansas | Ambetter from AR Health & Wellness |

| Arizona | Ambetter from Arizona Complete Health |

| Florida | Ambetter from Sunshine Health |

| Georgia | Ambetter from Peach State |

| Kansas | Ambetter from Sunflower Health |

| Mississippi | Ambetter from Magnolia |

| Missouri | Ambetter from Home State |

| Nevada | Ambetter from Silver Summit |

| Ohio | Ambetter from Buckeye Health Plan |

| Texas | Ambetter from Superior |

| Washington | Ambetter from Coordinated Care |

The Costs and Options of a Plan

Health insurance plans offered by Ambetter are categorized into three main types: Ambetter Essential Care, Ambetter Balanced Care, and Ambetter Secure Care.

The health care categories differ with respect to monthly premiums, deductibles, and out-of-pocket maximums, in addition to the out-of-pocket maximums.

Despite this, each of them is a qualified health plan that covers essential health benefits, such as urgent care.

Vision and dental insurance are available with some Ambetter plans.

It is an optional insurance that can be added to your health policy and provides benefits such as eye exams, prescription eyeglasses, and dental cleanings.

An additional monthly premium is charged for policies with the vision and dental add-ons.

Ambetter offers several types of health insurance policies.

Below we have provided additional information about each category.

Ambetter Essential Care

Bronze metal plans are among the cheapest plans available on Ambetter’s Essential Care category of plans.

Those who are in excellent health and do not anticipate many routine medical expenses will be better off with bronze plans.

Such plans are usually used to pay for extremely high, one-time medical expenses.

|

Product

|

Deductible

|

Out-of-pocket maximums

|

Monthly cost for a 40-year-old

|

|---|---|---|---|

| Ambetter Essential Care 1 | $6,800 | $6,800 | $329.47 |

| Ambetter Essential Care 1 + Vision | $6,800 | $6,800 | $333.27 |

| Ambetter Essential Care 1 + Vision + Dental | $6,800 | $6,800 | $342.15 |

Ambetter Balanced Care

Plans in the Silver Metal category of Ambetter Balanced Care are typically less expensive with a lower deductible and out-of-pocket maximum.

However, the monthly premiums for these plans are higher.

Here is a list of some Silver Ambetter Balanced Care products.

Optional vision and dental add-ons are available on all of these plans, however, the premiums will increase.

|

Product

|

Deductible

|

Out-of-pocket maximums

|

Monthly cost for a 40-year-old

|

|---|---|---|---|

| Ambetter Balanced Care 2 | $6,500 | $6,500 | $460.80 |

| Ambetter Balanced Care 1 | $5,500 | $6,500 | $468.18 |

| Ambetter Balanced Care 10 | $5,000 | $6,700 | $487.53 |

| Ambetter Balanced Care 3 | $3,000 | $6,500 | $491.68 |

Ambetter Secure Care

With Ambetter Secure Care products, you will be provided with Gold metal tier coverages, which contain the highest premiums and low deductibles.

Having a lower deductible will help you qualify for coinsurance benefits.

For those with high medical costs, such as a monthly drug prescription, the Ambetter Secure Care Gold plan is their best option.

Ambetter only offers one Gold plan: the Ambetter Secure Care 3.

Benefits and Resources for Members

When you become a member of Ambetter, you will enjoy additional member benefits such as a reward program and a nurse advice line.

Additionally, you can earn reward dollars by meeting your health wellness goals and participating and completing the wellness activities through Ambetter’s MyHealthPays rewards program.

Rewards will be added to your MyHealthPays card automatically following a completed activity.

The Ambetter Wellbeing Survey, receiving an annual wellness exam from your primary care provider and receiving an annual flu vaccine are some examples of some of these activities.

There is a variety of activities for which reward dollars can be used, including:

- Your monthly premium payments

- Doctor copays

- Deductibles

- Coinsurance

- Everyday items at Walmart

- Utilities (gas, electric, water)

- Cell phone bill

- Transportation, education or rent

If you have any questions or concerns about your health, you can contact the nurse advice line, which is open 24/7.

You can get expert advice from the nurse in terms of what steps you should take next when dealing with your issue.

If you are experiencing back pain, you can discuss it with the nurse, who can advise you whether a chiropractor is necessary.

Ambetter portal/ Login

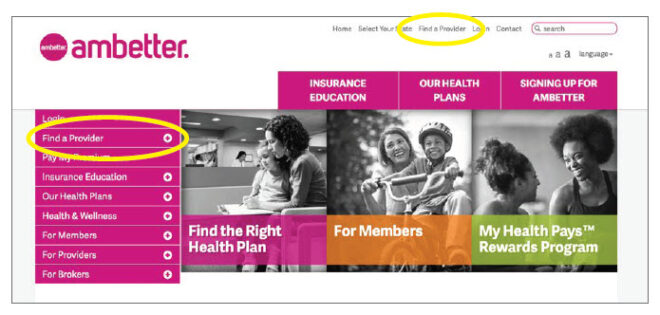

Through the online Ambetter portal, members can easily access all the benefits they are entitled to as Ambetters.

The site will allow you to log in, pay any premiums due, and view all of the benefits associated with your health care plan as well as order your ID card from the site.

Customer Reviews and Complaints

In case you are searching for health insurance with the cheapest rates, Ambetter Health Insurance may be the best option for you.

Ambetter Health Insurance, however, has been subject to negative reviews as well.

There is often a lot of complaint from policyholders about long wait times when it comes to contacting Ambetter employees, along with the fact that providers do not get paid for the medical treatments they perform.

Also, members have been complaining about being charged incorrectly and being unable to locate providers in their area that accept their Ambetter insurance.

Ratings for Ambetter Health Insurance support these customer reviews.

A “D” rating from the Better Business Bureau indicates this company rarely interacts with its customers or responds to complaints within a reasonable timeframe.

Telephone Number

If you would like more information about the Ambetter/Magnolia plans available on the Federal Marketplace, please visit www.ambetter.magnoliahealthplan.com or call 1-877-687-1187.

About Ambetter Health Insurance

Centene Corporation’s subsidiary, CeltiCare Insurance, operates Ambetter Health Insurance.

In the event you have questions after purchasing an Ambetter policy, Celticare is the point of contact for your questions.